I thought it was a done deal. I called 21st Century Insurance earlier this week and thought I had legitimately found an insurance company that writes personal policies with endorsements (riders) in Mississippi for the purposes of rideshare. However, when I called the company back yesterday, I was told by the agent that 21st Century doesn’t issue personal policies for people who wants to drive for a rideshare company. Not even part-time. They referred me to another insurance company and tried to tell me that I would require commercial insurance. Commercial insurance is not worth my time. It’s too expensive for a part-time rideshare driver.

Update: 2015/06/22 Found coverage in Mississippi through Liberty Mutual. **See notes below.

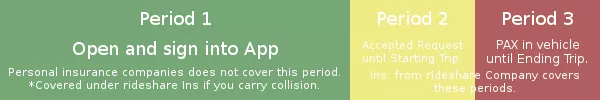

Period 1 is defined as Opening a rideshare app such as Uber, and signing in to the platform until the time of receiving a ride request from a pax. This is the dreaded “insurance gap”.

The following chart shows the different “periods” and how they effect a driver and their insurance coverage.

Period 1 IMO, should be covered under your personal policy. If the insurance companies wants to argue the point that you’re using your vehicle for-hire, at this point, it’s not true. You’re either parked or driving around at your own leisure as you see fit to do so.

Let’s break it down a little and make it easier to understand for insurance companies. If you are with a friend and they help pay for your gas, the way most policies are written, you’re creating insurance fraud because the fact that you’re transporting them and yourself for material or for a monetary value. This is the same thing that insurance companies argue with now about rideshare.

Periods 2 & 3 are covered only if you carry collision on your personal policy. Insurance companies are cancelling policies even if the rideshare company’s insurance covers these periods. Rideshare companies will insist that you report an MVR to your insurance company and in doing so, your primary insurance company may/will cancel your policy because you’re using your vehicle for-hire. Even if they are not required to pay out on the claim since Uber and Lyft issues their own Liability Insurance for drivers that will pay out in the chance you are involved in a motor vehicle accident.

Below is a list of states that rideshare drivers have coverage.

This list will be updated periodically.

- Arkansas

- Farmers Insurance

- California

- Farmers Insurance

- MetroMile

- District of Columbia

- Erie Insurance

- Colorado

- Allstate – 3rd Quarter 2015

- Farmers Insurance

- Metlife

- USAA

- Georgia

- Geico

- Indiana

- Erie Insurance

- Illinois

- Allstate – 3rd Quarter 2015

- Erie Insurance

- MetroMile

- Kentucky

- Erie Insurance

- Maryland

- Erie Insurance

- Geico

- Mississippi

- Liberty Mutual**

- North Carolina

- Erie Insurance

- Ohio

- Erie Insurance

- Oregon

- MetroMile

- Pennsylvania

- Erie Insurance

- Progressive

- Tennessee

- Erie Insurance

- Liberty Mutual

- Texas

- Allstate – 3rd Quarter 2015

- Geico

- USAA

- Utah

- Farmers Insurance

- Virginia

- Allstate – 3rd Quarter 2015

- Erie Insurance

- Geico

- MetroMile – Awaiting Approval

- Washington

- MetroMile

- West Virginia

- Erie Insurance

- Wisconsin

- Erie Insurance

Uber – Period 2 & 3 Certificate of Liability Insurance issued for drivers from Uber

Certificates Of Insurance – U.S. Ridesharing

Lyft – Period 1, 2, & 3 Certificate of Liability Insurance issued for drivers from Lyft

Lyft’s Insurance Policy – Lyft Driver Help

Sidecar – Period 1, 2, & 3 Certificate of Liability Insurance Issued for drivers from Sidecar

Insurance | Sidecar

While there are multiple insurance companies in the list, I am not affiliated with any of them. Hince, I can not recommend any of them.

* This is limited to a handfull of states such as Texas.

? No documentation from the company was given for covering the respective state. Information was found in a blog or news article.

** The way it was worded to me for coverage. As long as I’ve not got a PAX in my vehicle I’m covered by Liberty Mutual including Period 1. From the time I “Start the Trip” until I “End Trip” Uber’s insurance covers me.

Sources:

http://www.farmers.com/rideshare

Rideshare Insurance Coverage | Farmers ||

California Rideshare Drivers: contact a Farmers agent to add this new coverage!

https://www.metromile.com/insurance/

Per-Mile Insurance – Metromile

Per-mile insurance is an affordable insurance for people that don’t drive much. If you spend less time behind the wheel, you spend less money on insurance.

https://www.erieinsurance.com/about-us/locations

Erie Insurance Locations | Erie Insurance

Trying to find a high quality insurance agency near you? Check out these locations within ERIE’s footprint.

https://www.metlife.com/about/press-room/us-press-releases/index.html?compID=156259

Press Releases at MetLife

https://communities.usaa.com/t5/Press-Releases/USAA-Piloting-Ridesharing-Insurance-Coverage-for-Colorado/ba-p/56583

USAA Piloting Ridesharing Insurance Coverage for C… – USAA Member Community

Jan. 7, 2015 – USAA will pilot innovative auto insurance coverage in Colorado that will protect ridesharing drivers from the moment their rideshar…

https://communities.usaa.com/t5/USAA-News/USAA-to-Offer-Insurance-for-Rideshare-Drivers-in-Texas/ba-p/59239

USAA to Offer Insurance for Rideshare Drivers in T… – USAA Member Community

Transportation network companies are growing in popularity with riders all over the world — and also with thousands of military veterans and spouse…

http://thehub.lyft.com/blog/2015/3/10/progressive-pilots-ridesharing-insurance-in-pennsylvania

Progressive Pilots Ridesharing Insurance in Pennsylvania — The Hub

Fresh off the heels of MetLife’s ridesharing insurance in Colorado and GEICO’s in Virginia, Progressive just announced a ridesharing insurance .

https://www.geico.com/getaquote/ridesharing

GEICO | Ridesharing Insurance Quote

Get a free insurance quote for your ridesharing vehicle, and learn what coverage you need as a ridesharing driver.

https://www.libertymutual.com/auto-insurance

Auto Insurance, Car Insurance Online | Liberty Mutual

Explore affordable auto insurance options and get a free quote. Take advantage of benefits such as accident forgiveness and multi-policy bundling discounts.